How AI Is Transforming Financial Analysis and Reporting in Modern Enterprises

Artificial Intelligence (AI) is no longer a futuristic concept in finance—it’s a driving force reshaping how organizations analyze data, prepare reports, and make strategic decisions. With the ability to process vast volumes of financial data in seconds, AI empowers finance teams to move beyond manual number crunching and focus on actionable insights that guide long-term growth.

From automated reporting to real-time insights, AI technologies are revolutionizing the finance function by improving accuracy, transparency, and decision-making speed.

The Rise of AI in Financial Reporting

Over the past decade, finance departments have evolved from traditional, spreadsheet-driven reporting to data intelligence ecosystems powered by machine learning (ML) and natural language processing (NLP). Today, AI tools automatically extract, interpret, and visualize financial information from multiple systems—accelerating workflows that once required hours of manual work.

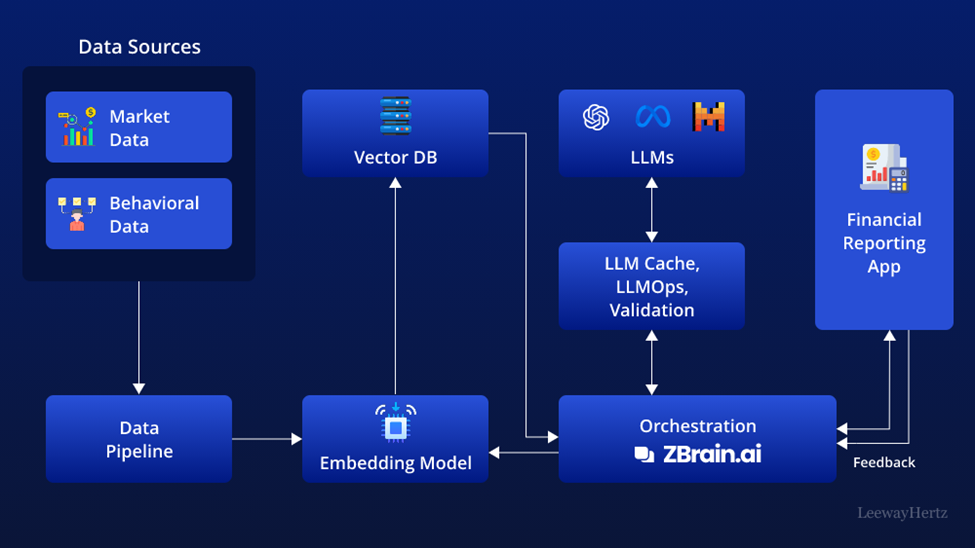

Modern AI-driven financial platforms like ZBrain’s Financial Insights AI Agent enable businesses to analyze performance trends, generate forecasts, and uncover anomalies in real time. This AI agent streamlines data interpretation by connecting to enterprise systems, identifying hidden financial patterns, and generating dynamic reports—all with human-like contextual understanding.

See also: Enhancing Your Home’s Entrance: Investing in High-Quality Doors

From Reactive to Proactive Decision-Making

Traditional reporting focuses on historical performance—what has already happened. In contrast, AI enables a proactive approach by forecasting future scenarios based on existing data. Predictive models can assess risks, detect inconsistencies, and even recommend corrective measures before issues escalate.

This transition allows CFOs and finance leaders to shift their focus from “what went wrong” to “what’s likely to happen,” ultimately improving operational agility and business resilience.

How Generative AI Is Changing Corporate Accounting

One of the most powerful innovations in this space is Generative AI, which extends the capabilities of traditional analytics through automation and intelligent report generation. Instead of manually compiling data, finance teams can now rely on AI systems to generate contextually relevant financial summaries, insights, and compliance-ready documents.

Platforms such as Generative AI for Corporate Accounting illustrate how enterprises can automate complex accounting processes—from reconciliations and journal entries to financial close reporting—without sacrificing accuracy.

Streamlining Financial Workflows

Generative AI helps finance teams:

- Automate repetitive tasks such as data entry, validation, and consolidation.

- Reduce human error in reporting and ensure compliance with regulatory standards.

- Create AI-generated financial narratives that translate raw data into business insights.

- Accelerate closing cycles and deliver accurate reports faster than ever.

This shift enables finance professionals to focus on strategic functions like budgeting, forecasting, and performance improvement rather than manual accounting tasks.

Benefits of AI in Financial Analysis and Reporting

AI technologies have moved beyond automation—they now enhance financial intelligence through adaptive learning and real-time analytics. Here’s how:

1. Enhanced Accuracy and Consistency

AI algorithms analyze data from multiple sources and validate entries automatically. This minimizes inconsistencies that typically occur during manual data handling.

2. Real-Time Financial Insights

AI-powered dashboards and agents provide live visibility into cash flows, profit margins, and expense patterns, enabling instant decision-making.

3. Improved Compliance and Risk Management

AI systems can cross-check transactions against regulatory frameworks, flag anomalies, and generate audit-ready reports. This ensures organizations stay compliant while reducing financial risks.

4. Predictive Analytics for Smarter Planning

Machine learning models analyze historical data to forecast revenue trends, cost fluctuations, and market changes—allowing companies to plan proactively.

5. Data Democratization

AI-driven platforms make financial insights accessible across departments, not just for analysts. Business leaders can interact with AI assistants to generate customized financial summaries, fostering a culture of data-driven collaboration.

Use Cases of AI in Finance

AI has already established its value across multiple financial functions:

Automated Financial Reporting

Finance teams use AI to prepare real-time reports directly from ERP systems without manual consolidation.

Expense Forecasting

AI models predict upcoming expenses based on spending behavior, helping organizations allocate budgets more efficiently.

Fraud Detection

By learning patterns in transaction data, AI can detect irregularities and alert teams to possible fraud in real time.

Financial Close Automation

AI accelerates reconciliation and close processes, ensuring timely, accurate reporting with minimal human intervention.

Challenges and Best Practices for Adopting AI in Finance

Despite its potential, integrating AI into financial systems requires careful planning. Key challenges include data quality, integration with legacy systems, and governance. Organizations must ensure that AI models are trained on clean, structured data and comply with relevant accounting standards.

To successfully implement AI in finance:

- Start with clearly defined objectives (e.g., automation, insights, compliance).

- Use AI agents that integrate seamlessly with existing ERP and BI tools.

- Establish human oversight to validate AI outputs.

- Continuously retrain AI models with updated financial data for accuracy.

The Future of AI in Financial Reporting

AI is redefining how organizations perceive and utilize their financial data. The next wave of innovation will focus on autonomous finance ecosystems, where AI agents interact dynamically to perform end-to-end financial operations—spanning analysis, reporting, forecasting, and compliance—without manual input.

Enterprises adopting such intelligent automation today will gain a lasting advantage in agility, transparency, and scalability. As AI continues to evolve, the finance function will shift from transactional operations to strategic intelligence hubs that drive value across the organization.

In essence, AI in financial reporting is not just about automation—it’s about transformation. From generative accounting tools to intelligent data interpretation agents, finance teams now have the technology to turn data into insight, insight into action, and action into measurable business growth.